Did you know that over 35% of Malaysian companies faced penalties in 2024 for breaching basic statutory requirements? From late annual filings to unqualified company secretaries, corporate non-compliance isn’t just common, it’s costly.

If you’re running a business in Malaysia, staying on top of corporate compliance is no longer optional. With stricter enforcement from the Companies Commission of Malaysia (SSM) and regulatory bodies in 2025, every company from startups to seasoned Sdn Bhds needs a solid compliance game plan.

In this guide, we’ll break down the top 10 compliance requirements every Malaysian company must meet in 2025, what happens if you miss them, and how Tramore Holdings can help you dodge expensive mistakes. Let’s dive in.

Key Requirements for Corporate Compliance in Malaysia (2025 Edition)

Every business in Malaysia must:

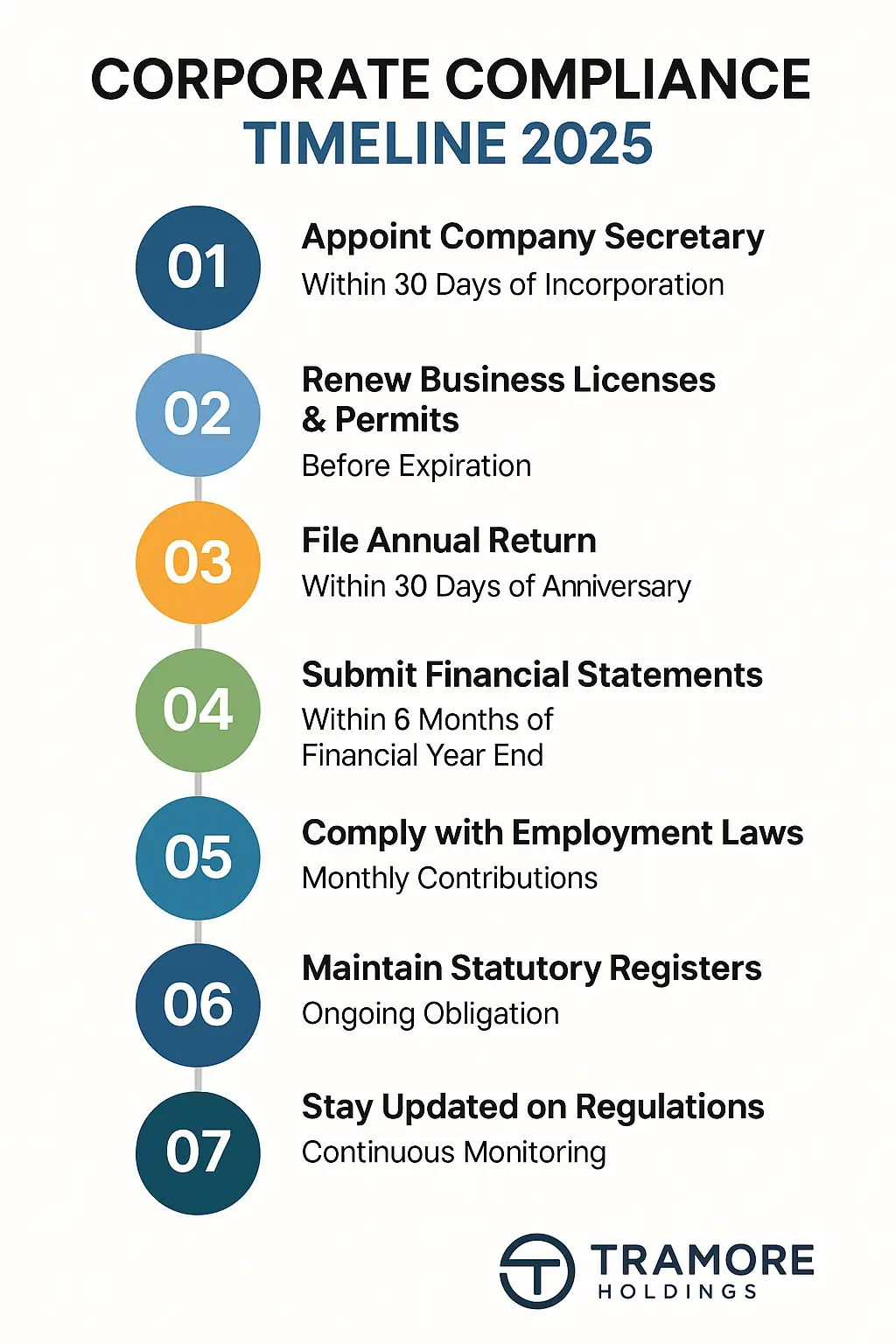

- Appoint a qualified licensed Company Secretary within 30 days of incorporation.

- File Annual Returns and Financial Statements punctually with SSM.

- Hold Annual General Meetings (AGMs), if applicable.

- Maintain a proper Register of Members, Directors, and Secretaries.

- Ensure valid business licenses and permits are up to date.

- Fulfill income tax, SST (if applicable), and EPF/SOCSO/EIS contributions.

- Adhere to Anti-Money Laundering (AMLATFPUAA 2001) regulations.

- Protect personal data under the Personal Data Protection Act 2010 (PDPA).

- Follow sector-specific regulatory compliance.

- Engage in proper contract management.

Top 10 Compliance Requirements for Malaysian Companies in 2025

1. Appoint a Qualified Company Secretary

It’s a legal requirement under the Companies Act 2016 to appoint a licensed company secretary within 30 days after incorporation.

Pro Tip: Not all secretaries are created equal in Sabah, approvals can get held up due to unlicensed or inexperienced secretaries. Tramore Holdings has 24 years of experience navigating local SSM quirks.

Warning: Never skip this appointment it’s a criminal offence.

2. File Annual Returns (Section 68)

Deadline: Within 30 days of your company’s incorporation anniversary date.

Failure to file this on time can lead to fines of up to RM50,000 per officer and eventual company deregistration.

What’s Included: Company particulars, directors, shareholders, and secretary details.

3. Submit Audited Financial Statements

All companies must file financial statements within 6 months of financial year-end (FYE) and submit them to SSM within 30 days after the AGM.

1. Appoint an auditor

2. Prepare financial statements

3. Hold AGM (if applicable)

4. Submit to SSM

4. Renew Business Licenses & Permits

Depending on your business nature, your licenses require annual or periodic renewal.

Common Mistake: Overlooking license expiry dates.

Example: A client in Kota Kinabalu nearly faced closure for missing a food handling permit renewal.

CTA: Need help managing license renewals? Talk to Tramore Holdings today.

5. File Corporate Income Tax and SST (if applicable)

- Income Tax: File CP204 and CP204A for estimated tax payable.

- Corporate Tax Return (Form C): Due 7 months after FYE.

- SST: Required if annual taxable turnover exceeds RM500,000 (services) or RM1.5 million (goods).

Penalty: Up to RM20,000 fine and possible imprisonment.

6. Maintain Statutory Registers & Minute Books

Maintain updated registers of:

- Directors

- Members (shareholders)

- Secretaries

- Charges

- All company resolutions and minutes

Penalty: Fines of RM10,000 per offence.

7. Ensure Compliance with Employment Laws

Register all employees for EPF, SOCSO, and EIS and contribute monthly deductions on time.

Risk: Late or missing contributions are punishable.

8. Adhere to AMLA (Anti-Money Laundering Act)

High-risk sectors must:

- Appoint a compliance officer

- Conduct customer due diligence

- Submit suspicious transaction reports

Sabah Focus: Increased inspections on law firms and property agencies.

9. Follow Personal Data Protection Act (PDPA) 2010

If collecting personal data:

- Register as a Data User (if applicable)

- Obtain consent before collection

- Secure data storage and usage

Common Pitfall: Small businesses assuming exemption.

10. Stay Updated on Sector-Specific Compliance

Additional industry-specific requirements:

- Construction: CIDB licensing

- F&B: Halal certification, premise licenses

- Financial services: BNM regulations

- Manufacturing: DOE & MITI permits

Client Story: A Sabah manufacturer avoided 3 weeks of delays after a compliance audit flagged an expired MITI permit.

Why Hire a Professional Company Secretary?

Local Expertise Matters: SSM in Sabah enforces unique procedural nuances often missed by out-of-state firms.

Tramore Holdings Advantage: With 24 years managing compliance in Sabah, we know the system and the people.

CTA: Let us manage your compliance headaches while you grow your business.

FAQ

Q: How much does it cost to register a Sdn Bhd in Sabah? A: Fees start from RM1,500. Tramore Holdings offers tailored packages.

Q: Can a foreigner be a company director in Malaysia? A: Yes provided there’s one local resident director.

Q: What’s the difference between a company secretary and a director? A: A director manages decisions; a company secretary handles legal filings.

Staying compliant in Malaysia isn’t about ticking boxes it’s about protecting your business from fines, legal action, and disruptions. In 2025, with tighter SSM enforcement, ignoring compliance is asking for trouble.

We’ve unpacked the top 10 compliance requirements every Malaysian company must meet, from appointing a licensed company secretary to maintaining statutory registers and submitting annual returns.

The risks are high, but you don’t have to handle it alone. Tramore Holdings specializes in ensuring Sabah businesses are SSM-compliant and audit-ready. Whether incorporating your first company or scaling an SME, our seasoned team handles the paperwork, deadlines, and legalities.

Ready to get compliant and stay ahead? Book your free compliance health check with Tramore Holdings today.